Benefits of Cloud Accounting to Know

Benefits of Cloud Accounting to Know

- Less administration: With cloud accounting software, business owners remove the need to contend with time-consuming software installation, backups and other administrative tasks, because you’re accessing the software over the internet. You don’t need to buy or manage servers or other IT infrastructure to run your accounting software. You don’t have to perform regular backups of important financial data, because your accounting provider automatically does that for you. Less time spent on administration frees staff to spend more time on the productive activities that grow your business.

- Software is always up-to-date: Because the software is in the cloud, you always have the most up-to-date version. The cloud provider automatically updates the accounting software to include changes to tax rates and accounting rules and adds new features. You don’t have to worry about upgrading your software to stay up-to-date; whenever you log in, you’ll immediately get access to the latest version.

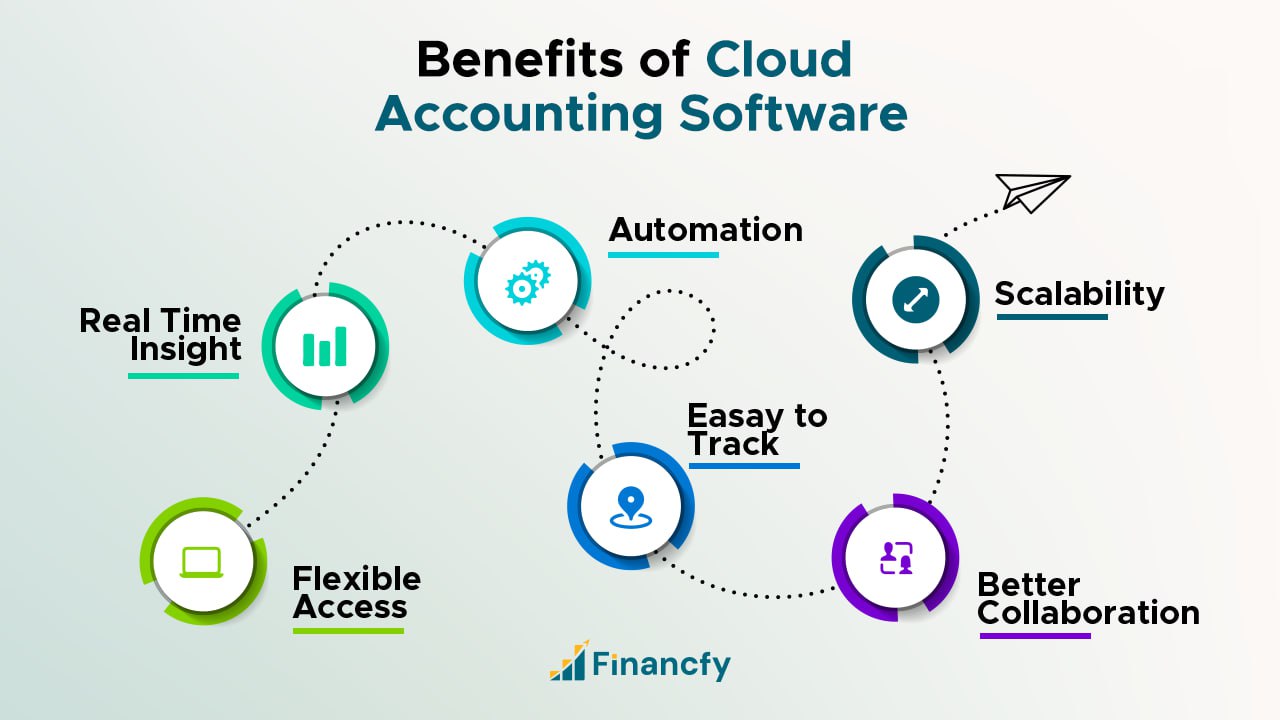

- Automation: Cloud-based accounting platforms automate many accounting and banking tasks, reducing manual work. For example, the software can automatically import bank and credit card transactions, produce recurring invoices, schedule reports, pay subscriptions and post transactions to the correct ledger. It may automatically calculate discounts and taxes and flag exceptions where invoices don’t match purchase orders. Some cloud accounting software programs are particularly useful for international sales, automatically handling tax calculations for many different countries.

- Ease of compliance: Cloud accounting platforms help private and public companies with tax compliance by producing accurate financial statements, quarterly tax estimates and yearly tax returns. This helps business owners avoid under-reporting tax liability, which could prompt audits or fines, or over-reporting and paying too much. By automating domestic and international tax calculations, cloud platforms also help ensure compliance with all applicable tax regimes. Some leading cloud accounting solutions even automate revenue recognition to comply with accepted accounting standards.

- Paper-free/eco-friendly: Traditional accounting often entails paperwork — lots of it. In today’s digitized world, it’s both inefficient and unnecessary to physically store archived paper records or manually distribute paper reports to investors, lenders and other parties. Ask vendors to send invoices electronically so they can be imported directly into the cloud accounting system. You can declutter the office by scanning paper bills and receipts for processing. Emailing your invoices to clients eliminates printing and postage costs and fast-tracks payment turnarounds. Cutting down on paper also reduces your environmental impact: The average office generates 350 pounds of waste paper per employee annually, and 375 million printer cartridges are incinerated or sent to landfills every year — and reducing energy consumption by reducing servers and hardware usages has an even greater impact.

- Data security: You may have concerns about storing sensitive information in the cloud. But cloud accounting services actually enhance security for most businesses in several ways. First, cloud providers apply multiple levels of security, including advanced encryption and access control, to ensure that only authorized users can access your data. They also automatically back up your data so you don’t run the risk of losing vital financial records. If an employee loses a laptop or an office is damaged by fire or flooding, your data is still secure since it is stored online. Your IT team can then focus on securing endpoints and making sure employees have the proper access rights for their roles.

- Scalability: One of the cloud’s most appealing features is scalability. Managing finances with spreadsheets quickly becomes unmanageable as a business expands, and desktop-based accounting systems typically offer limited functionality, which can hamper a growing business. If you’re a startup with expansion plans, for example, you don’t want to be stuck with a system you’ll outgrow in a year. Comprehensive cloud-based accounting software can scale and flex to match your business needs; you can start with basic accounting functions and add features and users as your business grows.

- Accuracy: Cloud-based accounting software improves accuracy by eliminating many of the error-prone manual steps that are required when using spreadsheets. In addition to automatically categorizing transactions and calculating taxes, cloud software can match received invoices to payments and shipments and even automate reconciliation processes, matching internal transactions to bank records and flagging errors.

- Single source of truth: Cloud accounting systems store all financial information in a single database, so everyone in the organization works from exactly the same information. There’s no more wasted time while teams try to figure out which version of a spreadsheet is correct. A single, central, authoritative data set ensures consistency across all accounting processes and financial reports.

- Customization: Every business is different, which is why it makes sense to choose cloud accounting software that can be customized to your organization’s individual needs. Some cloud accounting solutions allow you to tailor processes and workflows to better match the way your company operates. You can build personalized dashboards that provide each user with an at-a-glance view of their most important metrics and other information. You can also add corporate branding and company-specific terminology.

- Accessibility/availability: Unlike old-school desktop accounting software, cloud-based systems free you from the confines of your office. With online accounting software, authorized users can log in from any location, 24/7, through a web browser or mobile app. They can approve payments or send invoices without having to wait until they’re back in the office. Accounting team members are always plugged in to the most current financial information and real-time analytics. Because all data is stored in the same cloud-based system, it’s easier to share electronic documents among staff who are working at home or on the road. You also do not need to purchase addition software — like Citrix or VPN — to access true cloud software.

- Real-time reporting and data visualization: When the business manages accounting using spreadsheets or paper-based processes, it’s difficult to get a quick, accurate, up-to-date of view of business performance. As a result, leaders may not spot issues early enough to prevent them from developing into bigger problems. Cloud accounting systems can solve this problem by providing real-time access to centralized financial data. Instead of waiting for historical reports that are weeks or months out of date, users always have an up-to-date view of the company’s current financial position. Dashboards and other built-in analytics tools translate complex data into easy-to-understand charts and key performance indicators. Visualizing data enables the team to gain new insights and quickly identify trends that impact the business, and it costs significantly less with cloud software.